The Fundamentals of Top-Down Investing

Sep 15, 2022 By Triston Martin

What is Top-Down Investing?

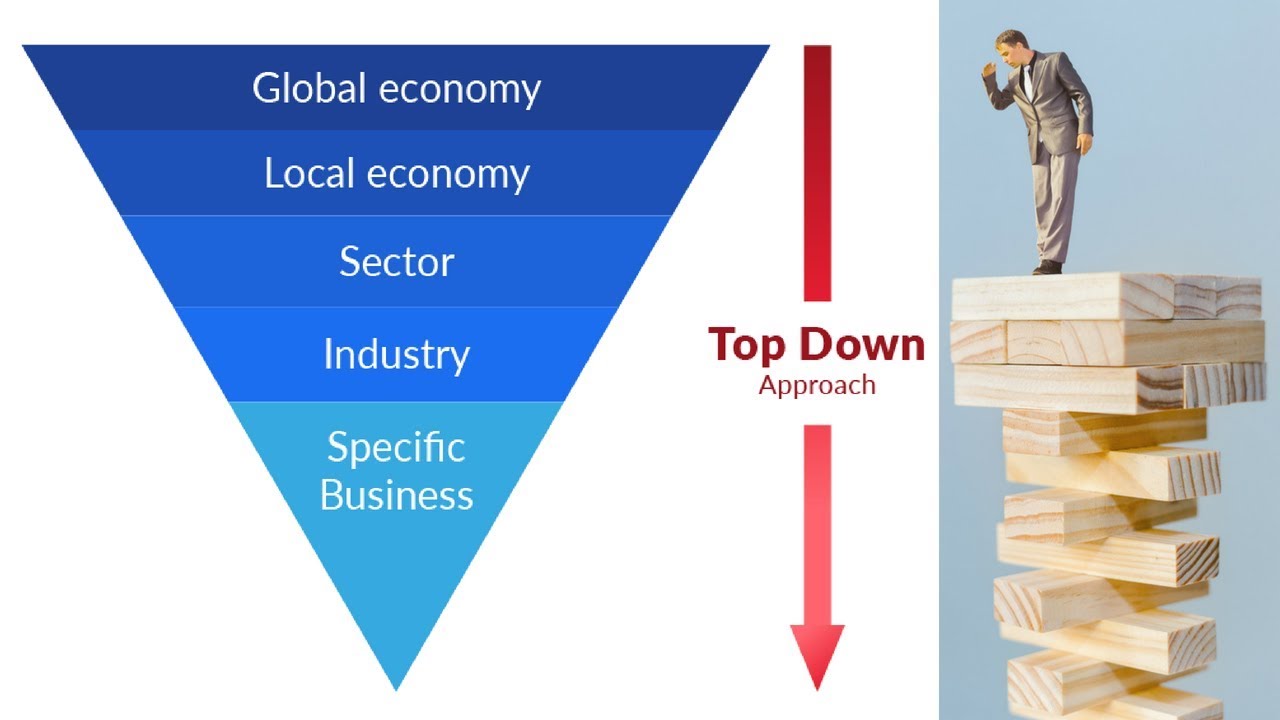

The top-down investing model is hypothesized as a funnel, wide on the top and getting narrower at the bottom. This investment strategy begins at the top, which is the macro sector, then goes down to micro factors. It focuses on nations and related factors such as Gross Domestic Product (GDP), taxation, and employment statistics.

Some financial experts claim that top-down investing considers the big picture. Investors making financial decisions using this model may eliminate options based on macro-level statistics before considering more micro ones, such as the financial standings of the companies they want to invest in.

An example of top-down investing is this: A businessman wants to invest in music production. Using this model, he will not consider the artist first but the country that the artist comes from and how well it performs musically on a global scale. They could buy Exchange-Traded Funds (ETFs) that track music production in the areas they are interested in, say, Africa.

Top-Down Investing vs. Bottom-Up Investing

Top-down investing is the opposite of bottom-up investing regarding the focal point. While top-down begins with the macro factors, bottom-up starts with the micro factors and then scales up. Bottom-up investing primarily considers a company's financial health before making important investment decisions.

The bottom-up model is more in touch with the grassroots, such as supply and demand, market share, and other micro factors.

Steps to Investing Using the Top-Down Investing Model

Identify the country

Top-down investing begins with selecting the country or region in which you want to invest. This means investing in the area's people, culture, and economic and political status. As an investor, the country's financial state matters a lot. Consider their currency, its volatility, and exchange rates.

Picking a country of choice that ranks well among global markets is a step in the right direction. Making this decision is challenging, as it will require careful consideration of all vital factors. A country that has been performing well for the past two years may not be a better option than one which has only been performing poorly over the last two years. Sudden successes should not shortchange you.

Identify the sector

Now that you know the geographical area that will be home to your investment, select the sector that meets your company's portfolio. Continuing in the music example above, an investor may now be free to choose between gospel or secular music. What appeals more to their preferences? Another apt example would be an investor in the health industry, whether they could select private health or public health.

This step is critical. The sector an investor chooses matters a lot in confining their business to that sector's rules and conditions of operation. If one selects the wrong industry, then focuses all their energy and money on it, it could have a boomerang effect on the overall business.

Investors may choose to invest in a sector and not diversify to specific stocks. For instance, in the tech industry, they could purchase ETFs or mutual funds comprising these stocks. Some investors stop at this point because they want to minimize the risk of funneling down to individual stocks.

Identify the assets or companies.

Before investing, it is always prudent to research well-performing stocks. The top-down investment approach would mean narrowing this search to your investment asset of choice. After selecting the particular asset you want to buy, you can now consider the companies that offer that asset. Would you be willing to merge or acquire them, build reasonable competition, or provide affiliate services?

Here, investors can now deeply consider company profiles, portfolios, financial statements, and market shares. They may also weigh the company's value using metrics such as cash flows and revenue growth. An investor may approve of a company but not its shareholders. In this case, restructuring may be necessary either before or after signing the requisite contracts.

Benefits of Top-Down Investing

Minimizing risk. The intensive research required to perform such an investment significantly reduces possible risk. As compared to other investment options, top-down investing covers more uncovered ground in terms of research. You will most likely select a company that is doing well, increasing your return on investment and reducing risks.

Diversification. Top-down investing allows you to spread your investment options to various parts of the world and thus enjoy returns from these diverse global markets. Investors could throw their bread to many waters. Another benefit of diversification is that investors are less likely to suffer from market uncertainties since they are always on their toes regarding national and regional factors.

Disadvantages of Top-Down Investing

Large-scale decisions could end up being wrong. Investors could have picked wrong opinions from analysts or performed the wrong research, which could have then informed wrong decisions. For instance, analysts could prospect enormous returns for investors in the next three months, yet this is a misinformed postulation. Since decisions are made via predictions and forecasts, there is even more pressure to ensure they are correct and factual, mainly because they deal with larger areas.

Some sectors may be ignored. While performing background research on major economic players, important sectors may be entirely ignored. These sectors may be more profitable than the sector that has been selected. The uncharted waters will always remain a possibility, and this ambiguity is almost painful to investors.

Conclusion

The top-down investing approach views the market from a larger picture than bottom-up investing. Investors need to select which investment option works out for them, depending on their personal preferences or what has worked out for them before. Top-down investing requires the investor to be more inclined and knowledgeable concerning a larger area, such as a country or region, to make more informed decisions moving forward.

While there are benefits to using the top-down approach, there are risks. Mostly, they will face both economies and diseconomies of scale as you consider top-down investing as your option of choice, happy investing!