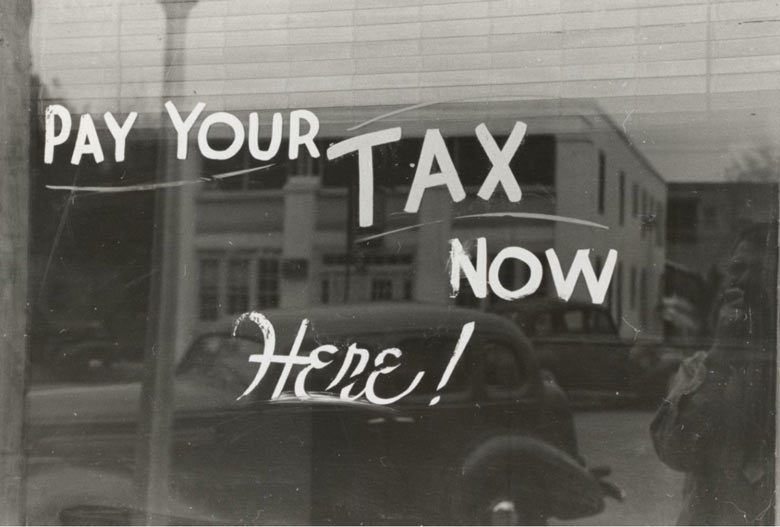

How To Pay Your Back Taxes And Get Relief

Aug 28, 2023 By Triston Martin

Back taxes are any money outstanding to the IRS, state and municipal tax authorities, or both. Moreover, you'll be in better shape if you pay your back taxes as soon as possible because they may increase over time due to interest and penalties.

There are several reasons you might owe back taxes, including:

- Insufficient taxes were withheld from your salary or other revenues.

- You sold investments, such as stocks, properties, or cryptocurrencies, and realized an unexpected profit.

Tax Relief

Tax relief refers to all government initiatives that help citizens pay less taxes. Tax relief is tax credits, deductions, or exclusions that reduce tax liability. Additional special tax relief programs are available to Americans affected by natural catastrophes.

Alton Bell II, the founder of Bell Tax Accountants & Advisors in Chicago, believes that several additional tax relief options enable consumers to pay their tax arrears reasonably. Furthermore, his firm's clients receive back taxes help that may overwhelm them.

The Way of Tax Relief function

According to Bell, tax relief programs differ depending on the taxpayer's financial situation and the amount of tax debt owed. He says no single program works best for every taxpayer's circumstances. Furthermore, we advise taxpayers to check IRS.gov to see which program suits their needs the most.

Tax relief could provide a more extended payment period or enable you to settle your tax bill for less money than you owe. Here are three relief alternatives from the IRS that want to help with back taxes if you owe them.

1. Short-Term payment plans

You can qualify for an IRS short-term payment plan if your total tax, penalty, and interest debt is less than $100,000.

You have up to 180 days to settle your account, and no costs are associated with using that time. However, interest and penalties will accumulate unless your payment is paid in full.

2. Installment Payment Plans

Here is the type:

Long-Term Payment Plan Fees

Option 1

Direct debit monthly payments

- Online application: $31 setup charge

- Call, write, or go in person to apply: setup cost of $107

- Taxpayers with low incomes might not have to pay any fees.

Option 2

Monthly non-debit payments

- Enroll online for a registration fee of $130.

- Call, write, or go in person to apply: $250 startup cost

- A refund of $43 of the low-income taxpayers' startup costs

Additionally, the IRS refers to a long-term streamlined installment arrangement to illustrate how these installment plans operate.

3. Offer in Compromise

An offer in compromise (OIC), which you negotiate with the IRS, reduces your tax liability. Additionally, as the term suggests, you propose paying the IRS some of what you have to pay, and as a negotiation, the tax authority agrees to waive the remaining balance.

Here's how it goes: Assuming you owe the IRS $50,000, you propose paying it off with $10,000. The remaining $40,000 in debt ($50,000 less $10,000) will be erased if the IRS approves your offer.

Furthermore, a $205 nonrefundable application fee will be applied to your account. Taxpayers with low incomes may be exempt from paying the fee. Additionally, it will want confirmation that all of your tax returns are current (or that you have submitted a legitimate extension) and that you have paid all needed approximated tax payments.

If you own a company with workers, you should be able to verify that all payroll tax deposits for the current and previous two quarters have been made. Moreover, if you have an ongoing bankruptcy proceeding that would preclude you from making a deal in compromise, the tool will also ask you about it.

4. IRS is "Currently Not Collectible" as of today.

The IRS will only try to collect your taxes if your account bears that classification. However, the loans won't disappear, and interest and penalties can continue. The IRS will add your tax refund to the sum that you owe if you discover you are due one while your tax debt is on hold.

Furthermore, to be eligible for CNC status, you must complete past-due tax returns and give the IRS financial information, including specifics about your income and expenses.

Once your account has the CNC designation, the IRS will audit your finances annually. Moreover, the IRS may attempt to recover the remaining debt owed if your financial condition improves.

5. You might work with a tax relief firm.

Working with a tax relief company to assist you in paying off your tax obligation can tempt you. Additionally, these companies offer solutions to help consumers pay off their taxes. The businesses assert they can suspend IRS tax collections and abolish tax debts.

Consumer watchdogs caution that many tax relief firms are fronts for con artists, even though other tax relief businesses are legal.

The Way Tax Relief Businesses Operate

Before deciding, Bell advises taxpayers to conduct due research on any tax relief company by examining its background and track record. According to the Federal Trade Commission, although businesses claim to be able to assist taxpayers who need help paying their taxes, they frequently need to catch up on their claims.

The FTC claims that many taxpayers aren't eligible for the tax relief programs these scammers promote; their businesses do not pay off the tax obligation and frequently forget to provide the IRS the necessary documentation requesting enrolment in the indicated program.

Furthermore, unhappy customers have complained to the agency, claiming that after paying tax relief programs or businesses hundreds of dollars, they were deeper in debt and unable to get refunds.

It's best to consult a tax expert or certified public accountant (CPA) about the tax relief programs available to help you settle your tax bills before you seek any tax relief.

FAQs

How many years can you file tax returns from a previous year?

Even if you cannot pay your back taxes, you should still file all past year tax returns. It's an excellent plan to pay as much overdue taxes as possible to avoid penalties and interest. You must file returns for the previous six years to earn the IRS's goodwill.

How soon can you expect to get your tax refund?

The average wait time for an electronic tax return is 21 days before you get your refund. Yet, submitting a paper tax return may require up to six months or more to get your money back.

Conclusion

We hope this information regarding how to pay back taxes is useful. You now have all the information you require regarding the available help if you need help making a tax payment.