What Is a 401(k)?

Jun 21, 2023 By Triston Martin

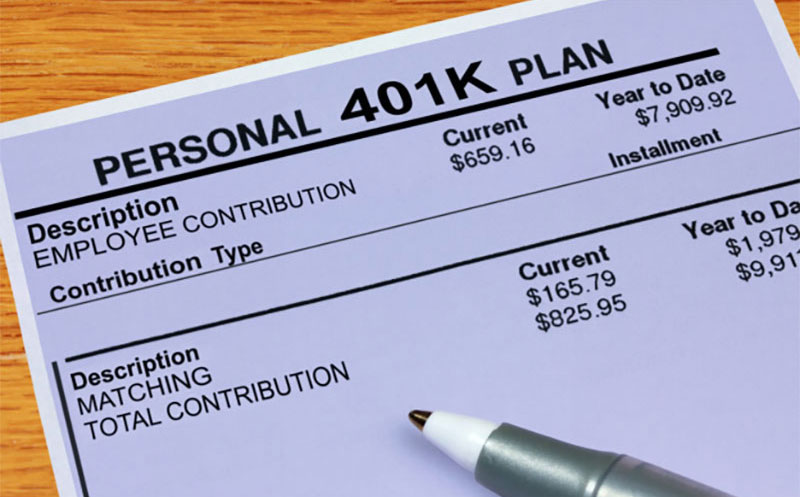

Are you wondering what a 401(k) is and whether or not it's the right saving solution for you? A 401(k) plan is a retirement savings account that allows employees to make contributions directly from their paychecks.

It can be a great way to begin planning for your financial future, but there are many factors to consider before opening one up. In this blog post, we'll break down exactly what a 401(k) is and explore its pros and cons so that you can decide if it makes sense for your situation.

Learn why you should (or shouldn't!) start investing in this plan.

What Is a 401(k) Plan?

A 401(k) plan is a popular savings for retirement option provided by employers in the US. Pre-tax contributions are those that are made by employees, meaning that the money is taken out of their paychecks before taxes are calculated.

How 401(k) Plans Work

401(k) plans work by allowing employees to contribute a portion of their salary to a retirement savings account. These contributions are deducted from the employee's income before taxes are applied, which means they can lower the employee's taxable income for the year.

The contributions are then invested in various financial instruments, such as stocks, bonds, and mutual funds, based on the employee's choices from a selection provided by the plan. The 401(k) plan investments grow on a tax-deferred basis, meaning the earnings are only taxed once they are withdrawn.

This allows the investments to accumulate more value over time. Many employers also offer matching contributions, where they contribute a percentage of the employee's contribution, which can promptly boost savings.

There are typically limits on how much employees can contribute to a 401(k) plan each year, as determined by the Internal Revenue Service (IRS). These limits may change from year to year.

Withdrawals from a 401(k) plan are generally subject to income taxes and penalties if taken before the age of 59½, with some exceptions for certain circumstances like hardship withdrawals or loans.

When an employee reaches retirement age or leaves their job, they can choose to withdraw the funds from their 401(k) plan. At that point, the withdrawals are taxed as ordinary income. Alternatively, they may roll over the funds into another qualified retirement account, such as an Individual Retirement Account (IRA), to continue deferring taxes until a later date.

It's important to note that the specific rules and details of 401(k) plans can vary as each employer establishes them within the guidelines set by the IRS. Employees should review their plan's documentation and consult a financial advisor for personalized advice regarding their 401(k) contributions and investment choices.

How do you get a 401(k)?

Most employers in the United States offer their employees 401(k) plans to save for retirement. Employers often provide enrollment materials and plan paperwork detailing the specific rules, regulations, and investment options.

Some employers may also offer assistance through an employer-sponsored advisor or financial consultant who can help employees understand their options and make informed investment decisions.

Employees can then choose how much of their salary to contribute to the plan and what investment options they want to invest in. Once enrolled, employers will deduct the contributions from an employee's paycheck pre-tax and transfer them into their 401(k) account.

Not all employers offer 401(k) plans, so it's important to check with your employer to see if they have a plan for their employees.

Types of 401(k)

Employers can offer employees different types of 401(k) plans. Here are a few common variations:

Traditional 401(k)

This is the most common type of 401(k) plan. Employees contribute a portion of their salary pre-tax, reducing their annual taxable income. The contributions and any earnings on investments grow tax-deferred until withdrawal.

Roth 401(k)

This type of plan allows employees to make contributions after tax, meaning the contributions are not tax-deductible. However, qualified withdrawals, including earnings, are tax-free in retirement. Roth 401(k)s are advantageous for individuals anticipating a higher tax bracket in retirement.

Safe Harbor 401(k)

This plan ensures that highly compensated employees (HCEs) can maximize their contributions without facing penalties for failing nondiscrimination tests. The employer must make contributions on behalf of employees, either as a matching contribution or a non-elective contribution.

Solo 401(k) or Individual 401(k)

This plan is designed for self-employed individuals or business owners with no employees except for a spouse. It allows the owner to contribute both as an employee and an employer, potentially allowing for higher contribution limits.

SIMPLE 401(k)

SIMPLE stands for Savings Incentive Match Plan for Employees. It is available for small businesses with at most 100 employees. It has lower administrative costs and simplified rules than traditional 401(k) plans. Employers must make either matching contributions or non-elective contributions for eligible employees.

These are just a few examples of the different 401(k) plan types available. Each plan may have specific rules, contribution limits, and eligibility criteria, so employees must review their plan's documentation and consult with their employer or a financial advisor for more information.

Annual 401(k) Contribution Limits

The Internal Revenue Service (IRS) sets annual 401(k) plan contribution limits. The limits may change yearly, and individuals should consult the most up-to-date information before making contributions.

For 2020, the maximum contribution limit is $19,500 per individual or $26,000 if aged 50 or older. Employers can also make matching or non-elective contributions for employees up to certain limits.

It's important to note that individuals can contribute up to their taxable income for the year, so if they have a lower salary due to retirement savings contributions or other deductions, they may be unable to maximize their contribution limit.

Employees should consult their employer or a financial advisor for more information about contribution limits and other rules that may apply to their 401(k) plan.

FAQs

What is a 401(k) plan?

A 401(k) plan is a savings for retirement plan offered by employers in the United States that allow employees to contribute a portion of their salary on a pre-tax or after-tax basis, with the contributions invested in various financial instruments for potential growth until retirement.

How does a 401(k) plan differ from an IRA?

While 401(k) plans and Individual Retirement Accounts (IRAs) are retirement savings vehicles, their origin, and management are the main differences. 401(k) plans are typically offered by employers, who may offer matching contributions, while IRAs are individual accounts established by an individual, independent of employment.

Can I withdraw money from my 401(k) before retirement?

Mostly, you cannot withdraw money from your 401(k) before reaching the age of 59½ without facing early withdrawal penalties and taxes. However, some exceptions exist, such as financial hardship withdrawals or loans, but these may still be subject to penalties and taxes.

Conclusion

In summary, a 401(k) plan is a great way to get ahead of your retirement savings and gain access to tax-free earnings. However, ensure you understand the associated costs, risks, and fees before deciding. Make sure you consider if it's the right fit for your needs and goals before taking the plunge- knowing what you want your money to do for you is important. This blog post has provided a high-level overview of everything you need to know about a 401(k).